Community Focused Market Making

Sep 9, 2022

· 2 min read

It’s been a busy week! The Stride blockchain launched, IBC was enabled, the ATOM / stATOM Osmosis pool was launched, and STRD incentives were added. Whew!

Now, in the next 24 hours, the STRD / OSMO Osmosis pools will be launched. This means that STRD trading will be available for the first time.

There are several ways that STRD will be distributed to the communities Stride serves. A large amount of STRD is currently being distributed as incentives for the ATOM / stATOM pool. Also, the airdrop to ATOM stakers is planned for near the end of the month, with more airdrops to follow for each onboarded chain. If users would like to acquire STRD now, they may do so using the STRD / OSMO pool.

The pool will be seeded with STRD from the Stride Association. But as the STRD airdrop has not yet been released, the circulating supply of STRD is currently a very small percentage of the total supply. There is a potential for strong volatility when the pool launches.

To mitigate strong volatility and ensure a smooth introduction of STRD, the Stride Association has engaged a market maker. The market marker will meet demand for STRD in an orderly manner, similar in spirit to the popular LBP feature on Osmosis. In the interest of transparency, below are the full details of how this will work.

The pool:

STRD will debut at a price of $1.25

To achieve this, the STRD / OSMO pool will be seeded by the Stride Association with $200,000 worth of OSMO and a corresponding amount of STRD to result in a STRD price of $1.25

The market maker:

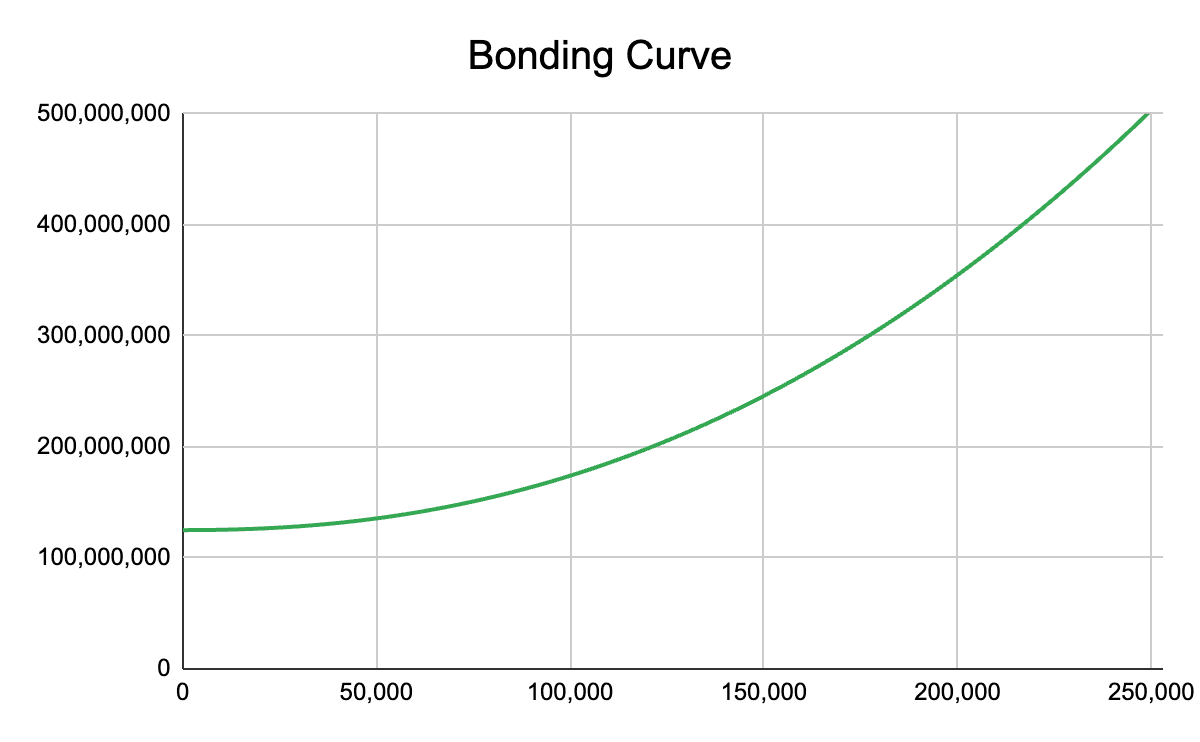

Sells a fixed amount of STRD at each price point. On a chart this forms a curve

If the price goes above the curve, the market maker will sell 1,000 STRD every 30 seconds until the price returns to the curve

If the fixed amount of STRD to sell at a give price point has been expended, the price will rise

The market maker has 250,000 STRD available

The market making program will continue for 7 days or until the 250,000 STRD is depleted; whichever comes first

So what does this mean for users? It means that liquidity is available for those who wish to acquire STRD from the market. Buy pressure will increase the price, but the increase in price will be cushioned by the market maker. To be clear, the price will increase in response to buy pressure, but the price increase will be smooth and gradual.

Remember, there are many ways to acquire STRD. Users may LP for the ATOM / stATOM pool to earn STRD incentives, or wait for the coming STRD airdrops. If users prefer, they can wait until the market making program is over to acquire STRD from the pool.

Details on transferring proceeds to the community: say the market maker hypothetically had proceeds of 500,000 OSMO over the 7 days. They will direct all 500,000 OSMO back to the AMM, so anyone who LPs STRD/OSMO liquidity (subject to a 14 day bonding) will receive these proceeds. The amount of incentives per day will depend on the total amount of proceeds received.