Stride Briefing: Third Edition

Nov 16, 2022

· 3 min read

The Stride Briefing is the easiest way to keep abreast of all things Stride! On a bi-weekly basis, the Briefing will concisely inform you of: recent Stride events, future Stride events, and provide current stats on Stride’s various Osmosis liquidity pools. The Stride Briefing will also serve to get new-comers up to speed.

Briefing #3, let’s go!

What is Stride?

Stride is a Cosmos-wide liquid staking provider. Using Stride’s liquid staking, you can earn staking rewards from Cosmos proof-of-stake tokens without having to stake them. Since your tokens remain liquid, you can deploy them in DeFi. This means you no longer have to choose between staking yield and DeFi yield. Thanks to Stride, you can have both at once.

Tokens supported: ATOM, OSMO, JUNO, STARS

Have questions? Check out Stride’s thorough FAQ, or join the Stride Discord.

Notable Recent Happenings

FTX blow-up:

As we all know by now, FTX has collapsed and contagion is spreading across the crypto industry. Stride Labs has no connection with FTX or FTX-affiliated companies. Stride Labs' treasury has not been impacted in any way.

Stride’s host-chain validator selection plan:

Stride has embarked on the process of selecting the its Cosmos Hub validator set, i.e. the validators on the Hub that Stride will use to delegate its users’ ATOM. Currently, validator applications and advisory council member applications are being accepted. Deadline for applications is November 27th!

Proposal to allocate Stride protocol revenue to STRD stakers:

A community member has made a forum post to propose that all Stride revenue be streamed to STRD stakers, for the service of securing the blockchain. Stride charges a fee of 10% on the staking yield of all tokens deposited. This is a steady, reliable, and significant source of revenue. If passed to stakers, it would make staking STRD much more attractive.

Members of the Osmosis community gathered to listen to a discussion about stOSMO. This concise, well-structured Twitter Spaces covers: why liquid staking is important, how liquid staking will help Cosmos DeFi mature, the risks of liquid staking, and how stOSMO could be the future of the OSMO token.

Up-coming Things

On November 22nd, the long-awaited Stride airdrop will take place. Stakers of tokens supported by Stride, testnet participants, and anyone who has deposited with Stride will receive an airdrop. In some cases the airdrop will vest and / or require the completion of tasks. Full details here.

stOSMO pool incentive prop soon:

The Osmosis governance forum has been discussing a recent proposal to add OSMO incentives to the stOSMO/OSMO liquidity pool. Expect an on-chain vote to go live imminently.

Sometime in November (or perhaps early December?), Stride will on-board the Injective chain and launch stINJ. There will be a liquidity pool on Helix (Injective’s premier DEX), as well as a customary airdrop to INJ stakers.

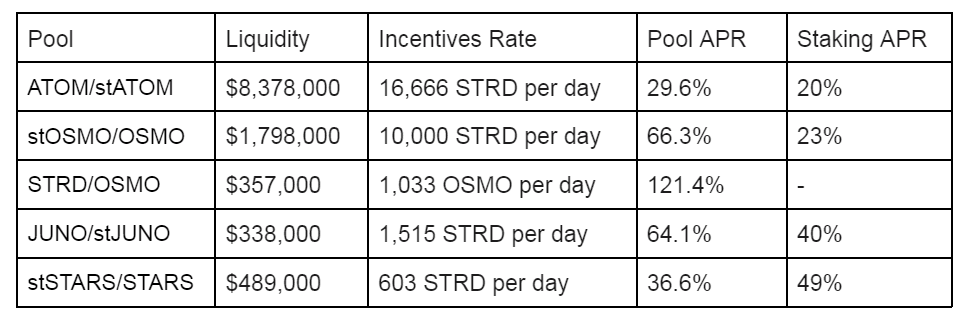

Stride Liquidity Pools Statistics

The following data is current as of November 16th, 14:00 UTC. Total APR given includes: all incentives; swap fees; and staking rewards earned by the stToken side of the pool.

stTOKEN/TOKEN pools give constant 100% exposure to a single token, meaning they have effectively no impermanent loss. In terms of risk, this makes providing liquidity for these pools basically the same as staking. But as you can see, the yields for LPing in Stride’s pools is almost always significantly higher than staking.

Pool Links

ATOM/stATOM: https://frontier.osmosis.zone/pool/803

stOSMO/OSMO: https://frontier.osmosis.zone/pool/833

STRD/OSMO: https://frontier.osmosis.zone/pool/806

JUNO/stJUNO: https://frontier.osmosis.zone/pool/817

STARS/stSTARS: https://frontier.osmosis.zone/pool/810

Stride Liquidity Pool Guidance

In order to be useful to DeFi applications, Stride’s stTokens need deep liquidity. Liquidity is incentivized with STRD and OSMO. Stride uses short-duration incentive gauges. Doing so provides more flexibility as opposed to long-term gauges. To be clear, Stride mainly wants the flexibility to easily add more incentives when necessary.

In order to give liquidity providers some assurance that Stride is committed to continually renewing its incentive gauges, Stride provides the following guidance:

1. If Stride wants to decrease the STRD per day incentive rate for any of its liquidity pools, Stride will always provide at least three weeks’ notice.

2. According to current expectations, it is highly unlikely that Stride will decrease the STRD per day rates for the stATOM pool or the stOSMO pool. Current incentives for those two pools are expected to be continually renewed for at least a year. Strategically, these are the two most important pools.

That's all for now!