Stride Monthly Recap: November 2023

Dec 14, 2023

· 8 min read

The Stride Monthly Recap is aimed at providing members of the Stride community monthly overviews of some of the most important developments at Stride. We will cover some of the key metrics we have been tracking internally at Stride, such as TVL growth and some of its key drivers. The recaps will also include product launches, new DeFi integrations, key forum posts, and exciting things to look forward to.

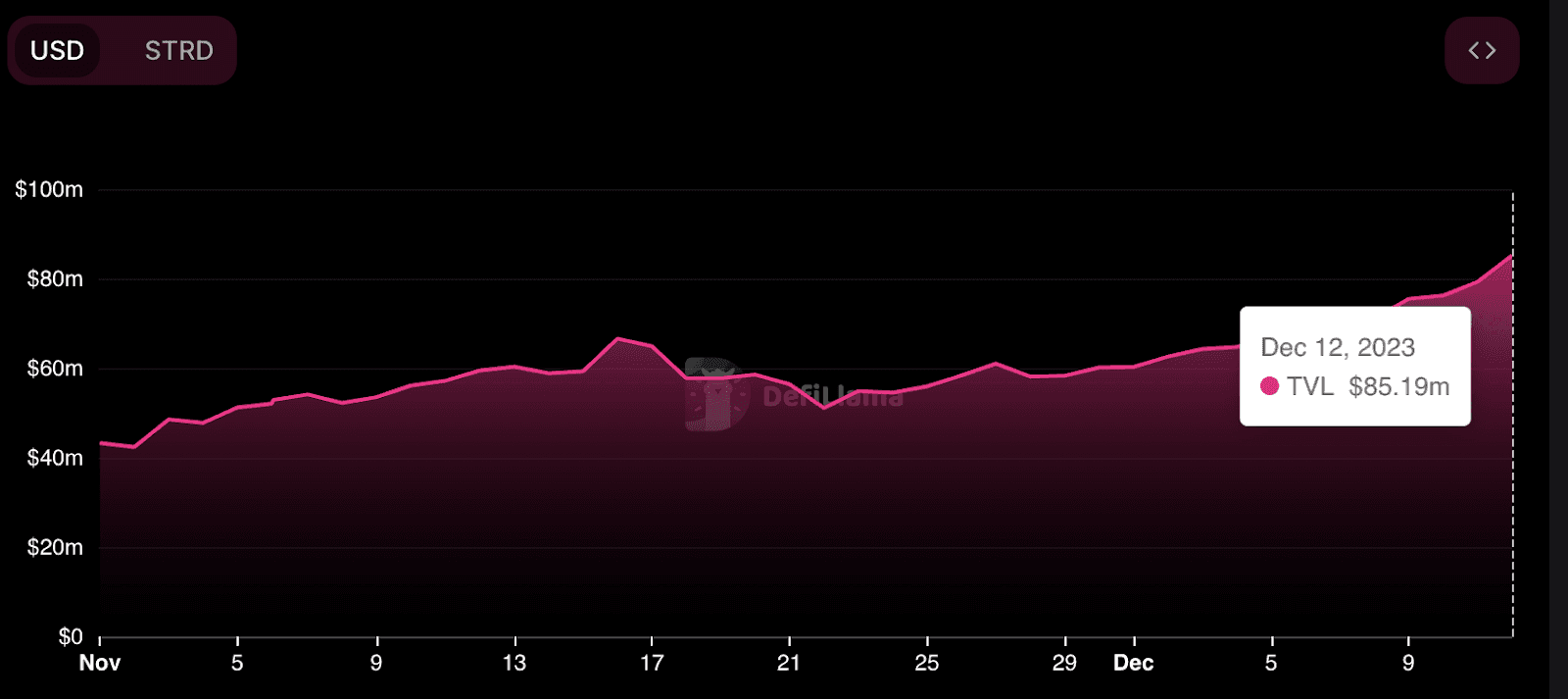

TVL Review

Stride’s TVL has grown 96% since the beginning of November, going from just over $43m to $85.19m over the course of six weeks. Here are some of the key drivers of this growth.

Strong Growth in Liquid Staking

The number of tokens liquid staked has been growing at a rapid rate. For example, the number of ATOM liquid staked with Stride is up almost 25% from 3.9m ATOM at the beginning of November. Additionally, the number of OSMO liquid staked with Stride is up by more than 16% from 20.4m OSMO at the beginning of November. (source: internal data)

Protocol Owned Liquidity

Stride’s TVL has also grown as a result of protocols deploying protocol owned liquidity, including the 20m OSMO deployed by the Osmosis Community Pool into the stOSMO/OSMO stableswap pool on Osmosis.

Price Action

The underlying price of the tokens liquid staked with Stride has also grown significantly over the past month. ATOM and OSMO have seen price gains of 49% and 302% respectively since the beginning of November. Other tokens for which Stride supports liquid staking, including INJ, JUNO and EVMOS, have also seen significant increases in price since early November.

Growth in Integrations

Increasing stToken utility is a key driver of TVL growth. By having an increasing number of ways in which users can leverage their stTokens across DeFi, users are more inclined to liquid stake their tokens. In particular, the Levana stATOM LP pool saw a 41% increase in TVL since early November. Another integration that has seen a surge of traffic has been the integration of stATOM as collateral for IST on Inter Protocol. The amount of stATOM being used as collateral against IST is up 489% since early November. A third integration that has seen a number of inflows is Kujira users minting its stablecoin USK using stATOM as collateral. The amount of stATOM being used as collateral on the USK market is up 267% since early November. (source: internal data)

Stride’s TVL between November 1 - December 12, 2023

DeFi Integrations

Stride has launched a number of new DeFi integrations since early November.

stOSMO on Levana

Levana has integrated stOSMO, allowing users to trade perpetual swaps on the price of stOSMO. Users can deposit stOSMO as collateral, in order to make leveraged trades on whether they think the price of stOSMO will increase or decrease. Additionally, users can deposit stOSMO in the LP pool in order to earn yield on trading activity. Currently, there is over $80k in liquidity in the stOSMO LP pools.

stOSMO on Mars

Mars Protocol now supports stOSMO as a collateral option. Mars is one of the largest lending markets in the Cosmos, and this integration means that users can now use their stOSMO as collateral, and borrow other tokens against it. Users have been quick to adopt this, with over $400k in stOSMO deposited as collateral already.

Quasar stATOM/ATOM Vault

Quasar launched its stATOM/ATOM Dynamic S+ vault. Users can deposit their stATOM and ATOM into this vault, which will dynamically manage liquidity positions in the stATOM/ATOM Supercharged Liquidity Pool on Osmosis. The pool currently has a cap of $1.8M, up from the $1M cap at launch. You can learn more about Quasar and its vaults here.

Mars High Leverage Strategies

Mars Protocol launched its high leverage strategies (HLS), allowing users to efficiently borrow funds to increase their staking position. Currently, the only two high leverage strategies supported by Mars are an stATOM strategy and an stOSMO strategy. You can learn more about Mars and its high leverage strategies here.

Key Developments

A look at some other key developments in the Stride ecosystem, including important governance proposals and protocol-owned liquidity (POL) deployments.

stOSMO POL Deployed

A governance proposal calling for the Osmosis Community Pool to deploy 20M OSMO (at current prices, $20.6m) in liquidity to the stOSMO/OSMO Stableswap Pool was passed in early October. That POL was recently deployed into the stOSMO/OSMO pool, making Pool #833 the largest pool on Osmosis. This instance of POL allows not only deepened liquidity to support even more DeFi integrations for stOSMO, but also signals strong alignment between Stride and the Osmosis Ecosystem.

stATOM/ATOM POL Governance Prop

A governance proposal on the Cosmos Hub forum that calls for 900k ATOM to be deployed into the stATOM/ATOM Supercharged Pool on Osmosis is set to pass on December 16th. This liquidity would be pivotal in ensuring deep liquidity in the concentrated liquidity (supercharged) pool, and serves the Cosmos Hub’s goals of promoting the adoption of liquid staked ATOM.

stATOM Borrowing Activity on Kujira

As mentioned above, stATOM has seen a surge in popularity as a collateral token on Kujira’s Ghost lending market. The amount of stATOM deposited as collateral on Kujira is up 267% since September, and there is high demand for users to mint Kujira’s native stablecoin USK using stATOM as collateral. In order to cater to this, the Kujira community has voted to raise the USK mint cap twice since early November. The community voted to raise the stATOM-USK mint cap to 750k, and then again to 1M in quick succession. This means that up to 1 million USK can be borrowed against stATOM as collateral.

stATOM Dominance on Inter Protocol

stATOM’s popularity as collateral for stablecoins is also on display on Inter Protocol, where the stATOM vault is the dominant choice for IST borrowers. 98% of the collateral deposited on Inter Protocol is stATOM, with the less capital efficient ATOM being the other option. Integrating stATOM as a collateral option has also boosted IST adoption greatly. Since adopting stATOM as a collateral option, the amount of IST in circulation has increased by over 5000%.

Proposals to List stATOM and stOSMO on Membrane

Governance proposals have just gone live on the Membrane Protocol’s governance forums on Discord to list stATOM and stOSMO as collateral options to mint CDT. CDT is a collateralized debt position stablecoin native to Osmosis. The defining feature of Membrane is the ability to mint CDT using multiple collateral assets at once. By using stATOM and stOSMO as part of these collateral “bundles”, CDT holders can diversify collateral risk while earning yield on the stAsset portion of their collateral. The proposals will be live for three days on the forums before being put up for a vote.

Upcoming Things

Here are some things to look forward to in the Stride ecosystem.

stDYDX Launch

Stride will be launching stDYDX in the coming weeks, making dYdX Chain Stride’s 11th host zone! DYdX chain will be streaming all trading fees to dYdX stakers, which means stDYDX holders will earn real yield. The Stride Protocol will swap the yield (denominated in USDC) for dYdX every six hours, and stake the newly converted staking rewards back on to dYdX Chain, resulting in auto-compounding for stDYDX holders. With the launch of trading on dYdX v4, stake distribution is of paramount importance. Liquid staking with Stride will play a pivotal role in dYdX’s security across a high quality, diversified validator set. To learn more about stDYDX, you can read our post on the dYdX forum and watch Stride core contributor Vishal’s Q&A session at a recent dYdX Community Town Hall.

stDYDX Airdrop

Stride recently announced a 250,000 STRD airdrop for DYDX holders. Holders will be eligible liquid staking their DYDX with Stride in the first 60 days of stDYDX being live. This airdrop is one of the largest STRD airdrops in Stride’s history, and symbolizes the importance of dYdX and stDYDX to the future of Cosmos DeFi.

Incentive Update

Liquidity incentive reductions in 2023

A crucial part of the Stride liquid staking experience is the availability of deep stToken trading liquidity on DEXes throughout the Cosmos. Trading liquidity ensures that users can conveniently exit from their stTokens without having to wait for an unbonding period. It also ensures that stTokens can safely be used as collateral, since stToken DEX trading pools are used as price oracles and need to be resistant to manipulation.

When Stride first launched in September of 2022, deep stToken trading liquidity was achieved through the use of liquidity incentives. Liquidity incentives are good for bootstrapping liquidity in the short term, but in the long run constant use of incentives is unsustainable.

That’s why a big initiative in 2023 has been reducing Stride’s dependence on liquidity incentives. Incentive emissions peaked in February of 2023, and have been gradually falling ever since.

How has Stride been able to reduce incentives while still maintaining safe levels of stToken trading liquidity? Three key ways. First, stToken liquidity has been moved to more efficient trading pools. Second, Stride has partnered with other DeFi projects to jointly incentivize stToken pools. Third, several Cosmos DAOs have voted to deploy their own liquidity to stToken trading pools. These steps have greatly improved the sustainability of Stride protocol. (See section below for current incentives emissions).

In addition to these three steps, in February of 2023 Stride governance voted to execute an OTC swap of 3M STRD for 1.5M USDC. (The purchased STRD was subject to a one year lock and vesting thereafter). Using this pool of USDC has enabled the incentivization of trading liquidity without immediate STRD emissions.

New proposal to OTC swap community STRD for USDC

The 1.5M USDC raised in February has now been nearly depleted. At current incentivization rates, the remaining USDC will run out this month. This would necessitate a return to using only STRD to incentivize trading liquidity.

Fortunately, with the current market conditions - now is an opportune time to use community STRD to raise a fresh amount of USDC for incentivizing trading liquidity.

The Stride Association is expected to soon post a governance proposal to do an OTC swap of community STRD for USDC. All pertinent information will be included in this forthcoming proposal. Stride governance will then have to decide to either accept or reject this proposal.

If Stride governance should choose to accept the soon-to-be-posted deal, the OTC swap can be executed by January 14th, 2024 at the lastest. This would result in a new pool of USDC to incentivize trading liquidity.

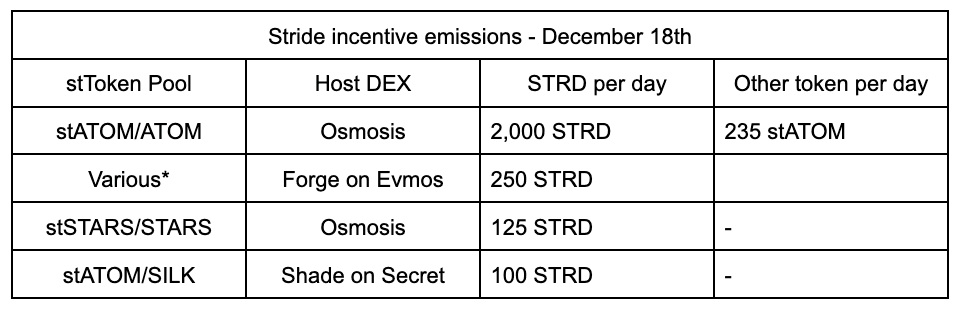

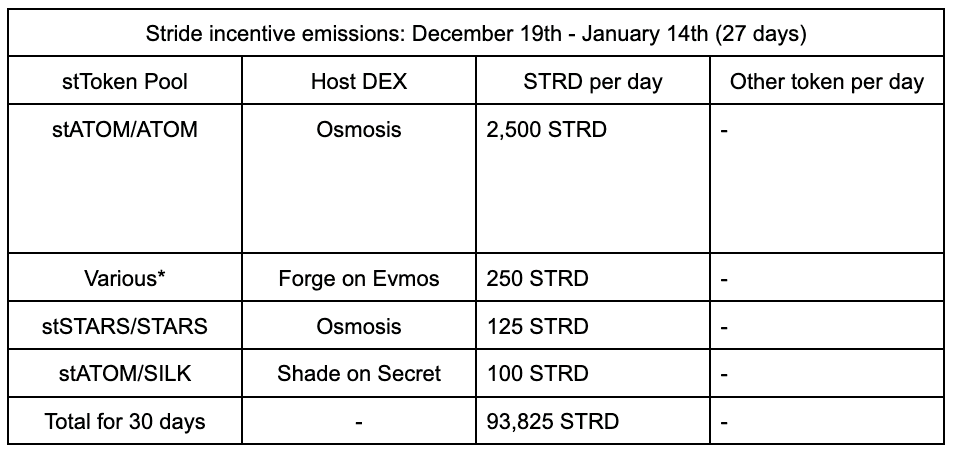

Incentive emissions for December and January

As mentioned above, the remaining USDC in the incentive pool will be depleted this month. As such, liquidity incentives for externally incentivized stToken pools will revert to just STRD. See the following two charts.

Future incentives emissions

Incentive emissions after January 14th will depend on the outcome of the forthcoming incentive diversification proposal.

If Stride governance approves the OTC swap of STRD, the majority of ongoing incentives will be non-STRD. If governance does not approve the OTC swap, then incentives will continue in STRD.

Regardless of the outcome of the vote, it is expected that the dollar value of incentives to the stATOM/ATOM pool on Osmosis will be reduced by roughly 50% after January 14th, to account for new stATOM liquidity that will likely be added to Osmosis when Cosmos Hub prop 858 passes. Aside from incentives for stATOM on Osmosis, the dollar value of incentives for all other categories will remain roughly the same.

Additionally, after January 14th all external incentives for stATOM liquidity will be directed to Osmosis pool # 1136. This is a crucial change for liquidity providers to be aware of. After January 14th, the original stATOM pool (# 803) will no longer receive external incentives. All Osmosis external incentives for stATOM will be directed to pool #1136. This should help liquidity transition from the xyk stATOM pool to the CL stATOM pool, increasing capital efficiency of stATOM liquidity on Osmosis.